This first-of-its-kind integration offers powerful, flexible automation to tackle growing fraud and security challenges.

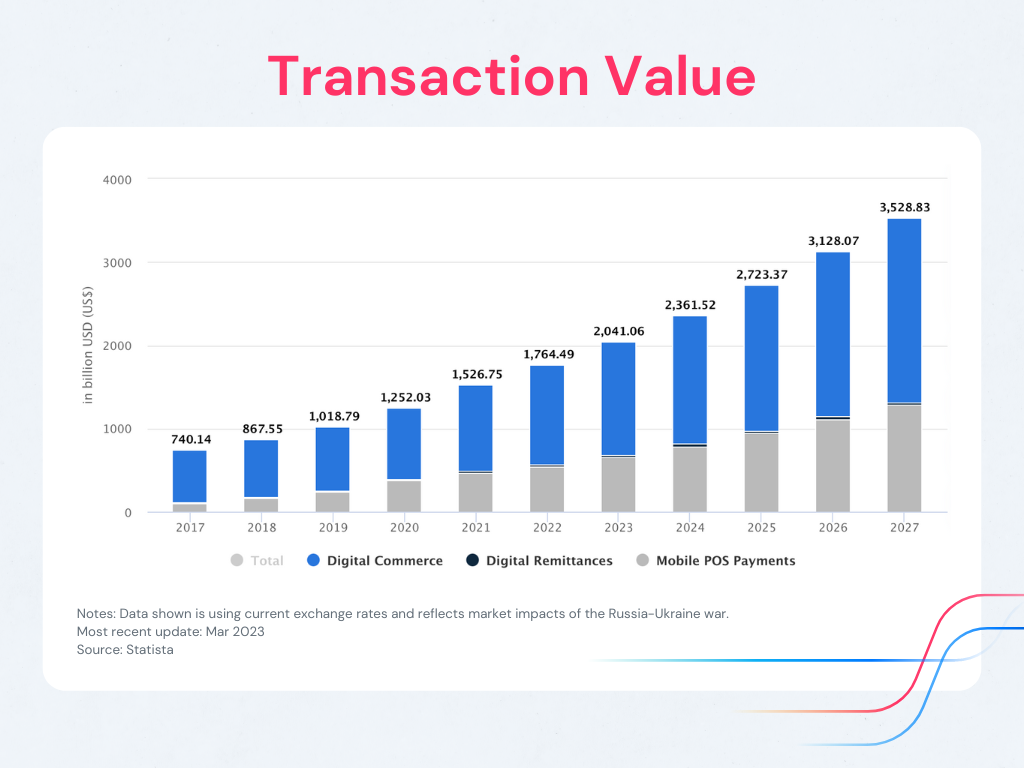

For businesses around the world, preventing financial fraud is a large and growing concern. As transactions continue to move to online e-commerce websites, the tools companies need to further evaluate transactions have played a greater role across fraud prevention teams.

Online transactions are forecast to continue their explosive growth well into the future, which makes fraud prevention a pervasive and costly problem for businesses of all shapes and sizes. This continued climb requires fraud teams to plan for a lot more on their “to-do” list in the coming years and to further prioritize tools that can save analysts time.

The Solution – A Streamlined Approach to Fraud Prevention

When it comes to financial fraud prevention, Kount, an Equifax Company, is one of the most robust offerings on the market. Their products offer deep identity and device information. They’ve also crafted a number of machine-learning capabilities to help customers improve their accuracy over time.

There is really no other tool on the market that offers the automation flexibility of the new Swimlane Turbine platform. Turbine can provide a consistent data format across vendors, provides a low code automation tool for beginners and developers alike, and offers a customizable user interface to fit use cases across teams or industries. Our modern SOAR has also proven itself across many unique use cases such as anti-cheating for video game companies, automated physical alerting to protect staff, and even the ability to automate large amounts of legal paperwork queues within law firms.

Partnering to Take On Fraud Prevention

As a low-code security automation company, Swimlane tackles the most complex automated use cases within and beyond the security operation center (SOC). Kount has a similar reputation on the fraud prevention side as one of the leading innovators in the fraud industry with a powerful offering. Today, we are excited to announce a robust integration together that will offer fraud teams a streamlined fraud prevention solution with the power of extended autonomous response across systems, departments and other tools.

Through this integration between Swimlane Turbine and Kount, security and fraud teams gain a streamlined approach to fraud prevention that works to speed up analyst response times across every transaction they’re tasked with reviewing. Together, we have designed a custom interface with analysts’ everyday needs at the forefront. Turbine leverages large amounts of data from Kount’s tool set within its UI and lays it out to provide analysts with the most valuable information first. As such, the decision-making process for Kount users has become more intuitive and leads to faster decisions.

This first-of-its-kind integration includes many of the features that make Swimlane Turbine both flexible and powerful. By ingesting data from Kount, Swimlane offers up new dashboards and reporting that are customized to what the user finds most valuable. Turbine also enables a number of single-click options for taking action – whether it’s an escalation, pulling in data from other systems to help with analysis or tearing down department silos that create large communication barriers.

Additionally, this tooling offers bonuses at the executive level, where risk can be calculated and displayed across different areas of the business. This provides leadership with a single product to visualize and better understand risk across fraud and/or cyber security. In turn, this enables teams to better recognize upticks in phishing or malware attacks for their effect on the fraud team.

Across all of these newly integrated ideas and features, there are a number of benefits that stand out. A few of the major advantages include:

- Increased speed across transaction analysis

- Shorter training time for new users, with data points prioritization

- Better visibility into risk across the business for leadership

- Single-click options to speed up analyst responses

- Hand time back to analysts and customer service representatives

New Functionality for Large Banks Coming Soon

All of the capabilities described above are available today via this integrated solution. But there are additional areas we believe automation can help even more. For instance, many large banks hold agreements with smaller merchants to fulfill credit needs across a specific time and dollar amount.

With Kount’s ability to see every transaction by merchant, Turbine can quickly ingest and automate threshold tracking. When a merchant is nearly full from a credit line perspective, Turbine can automatically warn these larger banks and the merchant of their proximity to these limits. Larger banks can then negotiate further credit before it becomes a problem or warn the merchant they are nearly maxed. This automation also provides the smaller merchant with advanced alerting when credit limits are high and gives them the ability to prioritize safer transactions over riskier ones.

Across these two use cases, there are substantial benefits for large banks and merchants alike. When dealing with numbers in the millions or billions, incremental gains can truly add up to huge sums. Combined with the streamlined approach we have today, large banks will truly find this partnership makes them more profitable across the board.

Contact Swimlane or Kount today to learn more about our new streamlined approach or to inquire further about the threshold automation’s ability to save money.