It’s no mystery that traditional cybersecurity attacks like phishing, insider threats, and ransomware, affect organizations in various industries. But, when it comes to the financial services industry, organizations grapple with unique complexities like financial fraud in addition to the traditional cybersecurity threats Financial institutions are under immense pressure from regulators, customers, and shareholders to balance technology innovation, investment, and persistent and evolving fraud attacks. To prevent attacks, organizations have employed artificial intelligence (AI), machine learning (ML), behavioral analysis, and biometrics to enhance threat coverage, efficiency, and maintain consumer trust and loyalty. However, in order for these tools to succeed in preventing fraud, security teams need a solution that enables real-time fraud detection, tool connectivity, and visibility across all teams, functions, and stakeholders. The challenge doesn’t end here; the introduction of new technologies has financial institutions including more items on their monitoring checklists for fraud.

Given this complex landscape, financial institutions have heavily invested in security solutions to proactively safeguard customer trust and minimize costs stemming from breaches.

- The largest financial organizations have over 100 security controls deployed

- The finance industry has more standalone products deployed than any other industry

We partnered with Omdia Research to gain a deeper understanding of the cybersecurity challenges that financial institutions face. Together, we conducted a survey involving over 300 security practitioners from the finance sector. One of the key findings of this research, detailed in The State of Security for Financial Services report, is the growing challenge to prevent fraud. Continue reading for a summary of how financial institutions intend to combat fraud.

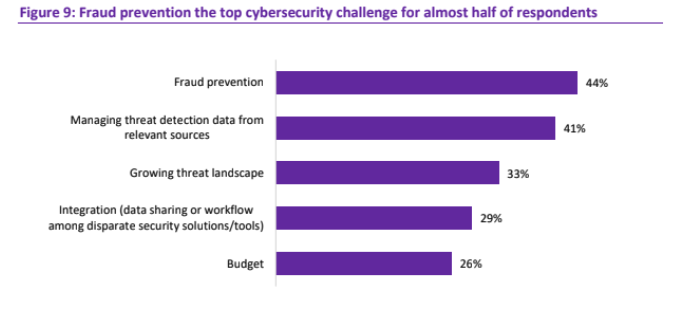

The Key Focus: Fraud Prevention

According to Omdia’s research, fraud is closely linked within all of the unique challenges the finance sector struggles with. Therefore and unsurprisingly, fraud prevention is the foremost cybersecurity challenge for financial institutions with 44% of respondents indicating it is their number one priority.

Why Fraud is on the Rise

The COVID-19 global pandemic was the catalyst for an abrupt rise in online shopping and virtual banking. This dynamic cultural shift paired with new technologies and payment methods, like Apple Pay and Venmo, has made fraud much more common and complex. This demands financial institutions to have more resources to monitor and respond when fraud occurs. Even though new types of fraud continue to emerge, generally fraud can be classified into four categories:

- Card fraud (card not present, counterfeit, lost/stolen, ID theft etc.)

- Remote banking fraud (internet banking, telephone banking, and mobile banking)

- Authorized push payment fraud (through deception and impersonation)

- Scams (purchase, investment, romance etc.)

So what does this growing challenge mean for financial institutions’ bottom line? There is a significant uptick from retail banks’ and how much they’re spending on anti-fraud systems to enhance monitoring, provide fraud analytics, case management, and fraud-related data services.

- By the end of 2024, retail banks will have invested $4.5 billion in anti-fraud systems globally, a 5.7% increase from the previous year

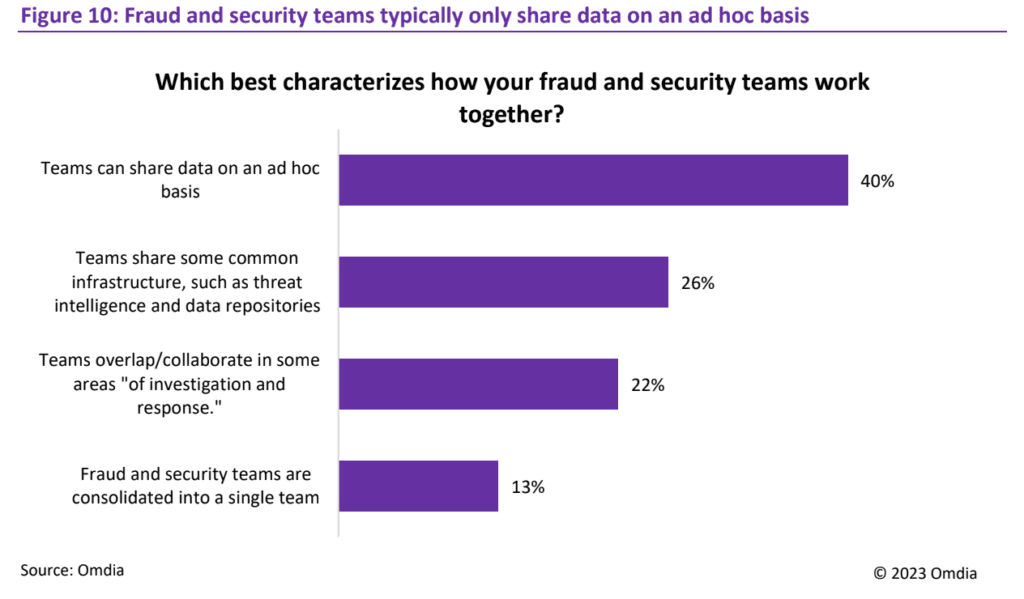

However, the lack of collaboration between security and fraud teams is gaining immense attention as emerging digital channels become the focal point for financial fraud.

The Fraud & SecOps Disconnect

Additionally, we’ve uncovered even more roadblocks: not only are security operations (SecOps) tools siloed, there’s also significant lack in collaboration between SecOps and fraud teams. This poses as one of the paramount reasons financial organizations are unsuccessful in preventing breaches and fraud.

- Almost half of the respondents have 31 or more separate security tools in place

- 63% of respondents plan to increase the number of deployed security products within the next 12 months

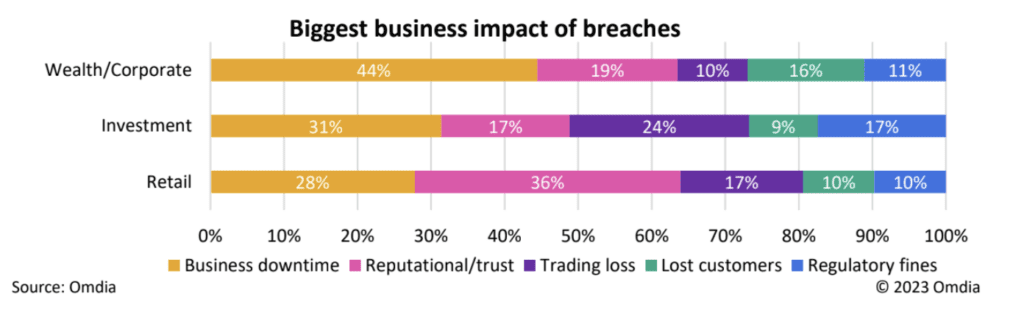

The Extreme Impacts of a Breach

Despite the industry’s numerous implemented security technology investments, the finance sector continues to fall victim to frequent, costly, and reputation altering breaches.

- 42% of respondents reported at least one breach with a total cost of $1 million

- 20% of respondents reported at least one breach with a total cost of $5 million

The consequences of successful cyber-attacks vary by financial institution type. Wealth management and investment banks prioritize downtime, while retail banks, with customers who can switch providers easily, focus more on reputation and customer trust.

How AI Enabled Automation Helps Prevent Fraud

97% of financial services companies plan to adopt security automation within the next 12 months.

“Security automation has emerging use cases for teams outside of the SOC, including fraud, compliance, legal case management and merchant onboarding,” said Andrew Braunberg, Principal Analyst of SecOps at Omdia. “For example, security automation is essential for security and fraud teams as they work to break down siloed tools, integrate with multiple data sources and gain increased visibility across their organization. Current rigid processes often aren’t allowing these teams to overcome these business challenges.”

Many finance organizations like InComm Payments trust Swimlane for AI enabled low-code security automation. To gain a deeper understanding of our research findings and assess your organization’s position within the statistics, download our State of Security for Finance report.

State of Security for Financial Services

Download the full research report now to have increased visibility on the unique financial services threat landscape